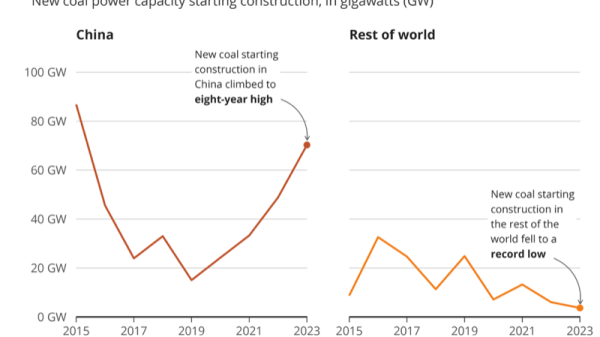

The latest inflation data from the Bureau of Economic Analysis largely confirm market expectations. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annualized rate of 3.1 percent in December 2024, up from 1.5 percent in the prior month. PCEPI inflation has averaged 2.2 percent over the last six months and 2.5 percent over the last twelve months.

Core inflation, which excludes volatile food and energy prices, was also in line with expectations. Core PCEPI grew at a continuously compounding annualized rate of 1.9 percent in December 2024, up from 1.3 percent in the prior month. Core PCEPI inflation has averaged 2.2 percent over the last six months and 2.8 percent over the last twelve months.

Figure 1. Headline and Core PCEPI Inflation, December 2019 – December 2024

The latest data will probably do little to resolve the question that is front-of-mind for Fed officials: is inflation on a path back toward 2 percent, or will it settle at some rate above target? Both headline and core inflation have declined over the past year. But they did not decline as fast as Fed officials expected. In December 2023, the median Federal Open Market Committee member projected 2.4 percent year-over-year headline inflation and 2.4 percent core inflation for 2024. In December 2024, the median FOMC member projected 2.4 percent headline inflation for 2024, slightly less than the 2.6 percent that was realized, and 2.8 percent core inflation, which was on the mark.

Although inflation has not fallen as fast as FOMC members expected, it has fallen. And there are good reasons to think it will fall further still. Nominal spending growth, as measured by Gross Domestic Product, has continued to decline. After surging to 10.3 percent for 2021, nominal spending growth fell to 9.4 percent in 2022, 6.4 percent in 2023, and 5.1 percent in 2024. In 2024:Q4, it was just 4.6 percent. For comparison, nominal spending growth averaged around 4.0 percent over the decade prior to the pandemic.

Figure 2. Gross Domestic Product, 2010:Q1 – 2024:Q4

Moreover, monetary policy remains tight. Earlier this week, the FOMC decided to hold its federal funds rate target range at 4.25 to 4.5 percent. Using December’s core PCEPI inflation as a proxy for expected inflation implies a real inflation-adjusted) federal funds rate target range of 2.35 to 2.6 percent. The New York Fed offers two estimates of the neutral rate, which economists call r-star. The Holston-Laubach-Williams model puts r-star at 0.77 percent. The Laubach-Williams model puts it at 1.26 percent. Hence, conventional estimates suggest the current federal funds rate target range is 99 basis points or more above target. This is consistent with my measure of the nominal spending gap, which has fallen from 4.46 percent in 2021:Q2 to just 0.83 percent in 2024:Q4.

Headline inflation rates will almost certainly decline over the next three months, as the high rates realized in January (5.1 percent), February (3.7 percent), and March (4.1 percent) 2023 drop out of the twelve-month calculations and are replaced with rates closer to those realized over the last few months. But if those declines are not big enough or do not persist into the months that follow, FOMC members will struggle to justify the two 25-basis-point cuts they have penciled in for this year.