Victor David Hansen, a noted military historian turned prolific pro-Trump commentator, said, on the Megyn Kelly Show, he “can’t think of a tariff that caused a major recession or depression.”

“[T]hey keep talking about tariffs, tariffs, tariffs, tariffs, recession, depression,” Hansen exclaimed. “I can’t think of a tariff that caused a major recession or depression. It didn’t cause it [in] 2008 — that was Wall Street.”

Regarding the recession of 2007-2008, I don’t know any economist who says that recession of or the subsequent hard times was caused by tariffs. Denying what no economist asserts is a cheap debater’s trick.

As to what was the main cause of that recession, it wasn’t the left-wing and populist bogeyman of Wall Street as Hansen asserts, although Wall Street contributed to that recession by inventing complex mortgage-backed securities.

The main cause of the recession of 2007-2008 was the promotion of home ownership by the federal government. The government (a) reduced down payments for FHA guaranteed-loans to zero, (b) doubled the amount of the government guarantee, (c) relaxed verification of income and employment history, (d) was permissive with regard to cash-out refinancing, and (e) maintained low interest rates and allowed the money supply and credit to increase faster than the long-run growth rate of the economy.

The housing bubble set into motion by the promotion of home-ownership by the government eventually burst, as it had to.

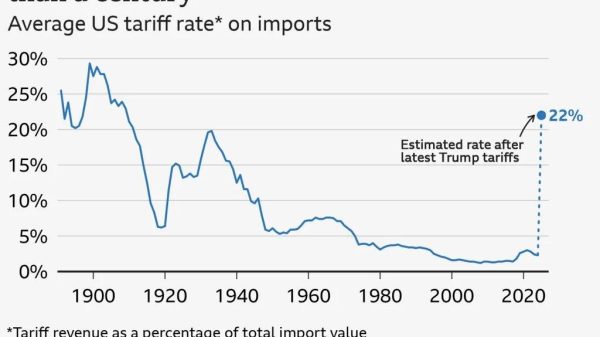

Returning to Hansen, “Anti-Trump corporate media and their pundits … cite the Smoot-Hawley Tariff Act of 1930 as having caused the Great Depression of 1929 – despite the fact the depression started prior to the Act being implemented.”

The only economist I know that says that the (main or initial) cause of the Great Depression was the Smoot-Hawley Tariff is Jude Wanniski (in his 1978 book, The Way the World Works). All the others who include the Smoot-Hawley Tariff in their analysis of the Great Depression say the tariff made the recession that followed the Stock Market Crash of October 1929 worse, adding to its depth and duration.

Wanniski says that the Stock Market Crash coincided with certain actions in the Senate concerning the Smoot-Hawley Tariff. The House had passed a tariff bill in May 1929, but the Senate debated the bill until the next year. Furthermore, support for a tariff bill was problematic in the Senate. Passage in the Senate was therefore crucial and dependent on deal-making and such. The final bill only passed in the Senate in March 1930 on a vote of 44 to 42. Thus, as Hansen says, the effective day of the tariff came after the Stock Market Crash.

But, as pointed out by Wanniski, the key to passage in the Senate was certain actions coinciding with the Stock Market Crash. On October 22, 1929, the Washington Times headlined “Senate coalition confident of rewriting tariff bill.” And, on October 23, 1929, “Bloc resumes tariff war.” (Here, “bloc” refers to the coalition of Senators promoting the tariff bill.) This news item concerns additional Senators joining in the coalition in return for higher tariffs on goods produced in their home states.

Then, on October 24, 1929, the Washington Times featured the front page headline “Stocks’ Crash Gets Worse.” The problem with Wanniski’s argument is that there was no mention of the tariff bill in this front-page article. Nor was there any mention of the tariff bill on the financial pages of that newspaper.

Surveying commentary from October to December 1929 in the Commercial and Financial Chronicle, none of the prominent economists of that time mentioned the tariff bill as a cause of the Stock Market Crash. Irving Fisher, for example, mentioned “unstable credit.” Indeed, economists generally did not anticipate a long or particularly severe recession. The Cleveland Trust investment advisory merely said that 1930 would have a poor start but would finish well. Guaranty Trust said the fall of inflated prices might be helpful.

Nor did the petition of the American Economic Association urging President Hoover to veto the tariff bill include on its list of probable consequences a long and severe recession. While tariffs might disrupt business, they are generally neutral with respect to jobs. Tariffs don’t increase or decrease the number of jobs; they shift jobs from employment in which countries have their comparative advantage to other other employment. Tariffs affect the productivity of jobs, not the number of jobs.

The petition was prescient with respect to the consequences it forewarned. The tariff would hurt our farm regions as agricultural products were a major export. There followed the dust bowl of the 1930s, and bankruptcies of numerous farms and rural banks.

The tariff would also hurt debtor nations that needed to export to earn the funds with which to repay their debts. Although not named in the petition, Germany was the main debtor nation of the world at that time (due to the Treaty of Versailles). Default and repudiation by Germany, and the collapse of world trade and finance, contributed both to the ensuing economic hard times and the rise of radical politics in the world.

As to why the Stock Market Crash was followed by the Great Depression, as opposed to being followed by a merely ordinary recession, following Milton Friedman, most economists say because the Federal Reserve allowed the money supply to collapse after the bank panics of November 1930-January 1931 and afterward.

The Smoot-Hawley Tariff, along with increases in ordinary taxes and the regulation of business were, thus, other contributors to the depth and duration of the Great Depression.

Again, in saying that economists say the Smoot-Hawley Tariff was the cause of the Great Depression, Hansen is misrepresenting economists. With a single exception, economists don’t say the Smoot-Hawley Tariff was the cause of the Great Depression. Those economists that include the tariff in their analysis of that troubled time generally say it made the recession worse.